INFORMAÇÃO

Por favor, aguarde...

Pedido submetido com sucesso.

Pedido submetido com sucesso.

It is up to the HEI partners to select the business ideas for the contest and to complete the respective application form.

Individual applications not recognized as selected by the respective Higher Education Institution for this purpose will not be admitted.

Only one idea should be chosen per Higher Education Institution, which will represent it in BfK Ideas.

For each sector, the jury will choose a winner. ANI reserves the right not to present an award in a particular category if it is verified that none of the applications are above a certain minimum score of excellence (i.e., thereshold), which is to be determined according to the evaluation criteria.

The categories may be found in the Regulation of each specific edition of the Contest.

It is up to the HEI, when completing the application, to classify the idea according to the contest categories.

Yes. All Portuguese HEIs are eligible to select and reference business ideas from their students, teachers and/or researchers.

Only the HEIs listed are partners of BfK Ideas, and are the only ones eligible to select and refer business ideas from their students, faculty and/or researchers.

If a public Portuguese HEI does not appear in the list of partners and intends to join the BfK Ideas contest, please reach out to us through the online form.

Yes. BfK Ideas is specifically designed for business ideas and not for mature projects.

BfK Ideas intends to empower the promoters of the idea and leverage their business potential.

There is no specific application phase for the BfK Awards.

The ANI is associated with existing innovation competitions and awards in Portugal, within which it presents a special 'BfK Awards' prize. To be selected, you must submit your application to one of the partner contests or awards, provided it fits your project or company.

The BfK Award is presented to one of the finalists in the partner contest/award, but is governed by its own set of evaluation criteria. The specific evaluation objectives and criteria of each contest/award are the sole and exclusive responsibility of the organizing partner entity.

In cases where the partner contest/award is international, the BfK Award is awarded to one of the contest’s national finalists.

The application deadlines and the scheduling of the award ceremonies are the sole responsibility of the organising partner of each partner contest/award.

The application forms of each innovation contest/award with which the ANI is associated already include the fields required in order to collect information and evaluate the BfK Awards criteria. If additional information is required, the ANI may collect the necessary data at a subsequent evaluation stage.

The 'Tree of Knowledge' is an exclusive piece of art by Leonel Moura, representing the winner's scientific excellence, social, environmental and economic impact. In order to certify the authenticity of this distinction, winners will also receive a certificate of their award signed by ANI.

Other awards may be considered under the terms of the partnership with the organizers of the innovation contest/awards with which ANI is associated.

The allocation of funding by the Innovation, Technology and Circular Economy Fund (FITEC), is governed by the provisions of Resolution No. 84/2016 of the Council of Ministers, of 21 December, in Decree-Law No. 86-C/2016, of 29 December, and in Administrative Rule no. 258/2017, of 21 August. What are the objectives

and what is the Core Funding for?

This funding will serve to support the Interface Centres through the allocation of multi-annual funding, which will enable them to increase the levels of financial stability and the definition of medium- and long-term strategies. This initiative is part of the Interface Programme, and its main objectives are:

Core Funding will be used exclusively to support the development of non-economic and pre-competitive activities (acting on 'market failures') by these Centres, and is not intended for commercial activities. The funding will be based on a plan of action with quantitative and qualitative objectives, which will serve as the basis for its evaluation. The overall level of funding for Interface Centres will be associated with achieving these objectives.

The entities recognised as Interface Centres (IC) may apply for funding under the terms of number 3 of article 7 of Ordinance no. 258/2017, of 21 August, at the application submission date to the respective Notices and that have their regular tax status. However, the Executive Committee of FITEC will regularly issue Notices, according to the available budget, to allow entities that are not yet recognised as IC to apply at the date of entry into force of this Regulation.

The planned allocation for the next 6 years is 80M€.

The allocation for the first year of funding Notice No. 1 is €12M.

The application consists of two main parts:

Yes. Each entity may receive a maximum of €3M distributed over the three years of funding, taking into account the rating obtained in the evaluation process and the average sales and service provision of each entity (2013-2015).

Applications are open until 23 May 2018.

See question 'Will all Interface Centres receive the same amount of multi-annual funding?'.

This rule should be applied in the accounting and disclosure of subsidies as well as other forms of government support. The accounting policy adopted should be disclosed as well as the nature and extent of the subsidies to which the entity has benefited.

The application and form must be written in Portuguese, and in English in the marked fields.

Non-economic activity means an activity that does not have a commercial or competitive nature in the market. To this end, the definition of the European Commission will be used, in accordance with the Commission Communication - Framework for State aid for research, development and innovation (2014/C 198/1)

The European Commission considers that the following activities are generally non-economic:

(a) Primary activities of research organisations and research infrastructures, in particular:

If a research organisation or research infrastructure is used for both economic activities and non-economic activities, public funding is covered by state aid rules only to the extent that it covers costs related to economic activities.

If the research organisation or infrastructure is used almost exclusively for a non-economic activity, its financing may be excluded in its entirety from the scope of state aid rules, provided that the economic use remains merely ancillary, i.e., it corresponds to an activity which is directly related to the functioning of the research organisation or infrastructure or is necessary, or intrinsically linked, to its main non-economic use and has a limited scope. For the purposes of this framework, the Commission will consider this to be the case if economic activities consume exactly the same inputs (such as material, equipment, labour and fixed capital) as non-economic activities and if the annual capacity allocated to these economic activities does not exceed 20% of the annual overall capacity of the relevant entity.

Without prejudice to the wording of the preceding two paragraphs, where research bodies or infrastructures are used to carry out economic activities, such as the leasing of equipment or laboratories to businesses, the provision of services to businesses or the conduct of research under contract, the public funding of these economic activities will generally be regarded as State aid.

However, the Commission shall not consider the research organisation or infrastructure to be a recipient of State aid if it acts as a mere intermediary, transferring all public funding or any other advantage gained through such funding to its final beneficiaries. This is what usually happens in the following cases:

(a) Both public funding and any advantage gained through funding are

quantifiable and demonstrable, with an appropriate mechanism ensuring that they are

fully transferred to the final beneficiaries, by reducing prices, for example.

(b) no other advantage is granted to the intermediary because it is selected by public contest or because public funding is available to all entities that meet the objective conditions necessary, so that customers as final beneficiaries are entitled to acquire equivalent services to any relevant intermediary.

If the conditions set out in the previous paragraph are fulfilled, the State aid rules shall apply to final beneficiaries.

Note: see Commission Communication Framework for State aid for research, development and innovation (2014/C 198/1).

This analysis will have to be done on a case-by-case basis, according to the European Commission's definition of non-economic activities. However, if sales and service support activities are considered, they may be considered economic activities.

Investment in buildings is not eligible. Expenditure on rentals of buildings are not eligible either.

Acquisition and amortisation may be considered.

Overheads costs are not considered.

Expenses for funding purposes are only eligible as of the application submission deadline - 23 May 2018. The entity is free to present a strategic business plan, which would begin upon signing the contract.

If this is ascertained during the implementation of the project, the unexpired amount may be allocated to another activity, provided it is justified and related to the project. If this is cleared at the end of the project's 3 years, the remaining funding may be included in a subsequent core funding period.

As provided for in number 5 of Chapter XV of the Core Funding Regulation, 'In the mid-term review, the FITEC Executive Board, on the basis of a reasoned proposal from the ANI, may change the amounts of funding, subject to the maximum fixed amounts, in accordance with the budgetary allocation envisaged in the Notice, and in the terms provided for herein'.

Example: If the expenditure of €100,000 for an equipment is foreseen for year 2, and the investment is made with a lower amount, the remaining amount can be reallocated to another heading, subject to justification by the entity and subject to evaluation by the ANI.

With regard to the recruitment of qualified human resources by the Interface Centres, objective 3 of the Regulation is clear in reference to young doctorates and other young specialist staff. Section b. of number 2 of chapter V states that, in order to strengthen scientific employment, a training programme is needed to justify the recruitment of X human resources for an indefinite term or for an uncertain term of office.

Recruitment of eligible human resources in this context must have an additional effect vis-à-vis the entity's initial establishment plan and simple changes in existing human resource categories or roles are excluded.

Example: If recruiting of a doctorate refers to a human resource already previously contracted (although with other functions or category), the KPI of 'human resources with contract' will remain the same, with no additional effect.

The contracting of PhD students to carry out research in the entity, and who are recipients of funding through research grants, will be possible after the completion of their PhD and the end of the associated scholarship. Therefore, expenditure on research grants is not eligible.

The plan to be evaluated consists of an overall strategy and budget for the three-year period. The combination of funding sources is important and will be taken into account for evaluation. The possibility of internships in the Interface Centres, funded by the Institute of Employment and Vocational Training, I.P. (IEFP), will be positively considered.

Link: https://www.iefp.pt/documents/10181/7118590/Regulamentos+EP_2+revis%C3%A3o-23-01-2018/32b038b4-24bb-457e-843e-2168fa43743f

Yes, 'Third Party Agreement' protocols (including the assignment of qualified human resources) can be accepted.

No, they cannot have a legal identity.

The merits of the application will be taken into account, applying the following coefficients to the terms established in the previous questions:

For evaluation purposes, the proposal may only achieve a maximum score if it includes at least 20% of the expenditure to be funded in qualified human resources.

After the closing of the contest, the evaluation period will take place within 40 working days, to which 10 business days will be added as a prior hearing period.

The final decision must be communicated within 5 working days after the evaluation period and prior hearing.

The 80% percentage refers to the amount of funding in the first year and to the applications considered 'excellent' - whose evaluation corresponds to 100% of the funding. 20% of the incentive for the first year will be held pending, and its payment will be subject to the overall evaluation of the implementation of the plan, that is, to the full realisation of the three-year plan.

For example: an entity has an approved three-year plan of €1.5 million and consequently, €500,000 for the first year. This entity will see 20% of this amount €100,000) held, which will be released after the final evaluation of the three-year plan, if it is implemented in full.

The proposed placement for the application is made according to various objectives and various sources of funding. Although the core funding will be for specific actions within an overall strategy, the evaluation will focus on the overall application proposal and the respective implementation proposal. Therefore, the evaluated KPIs are those referring to the total of the plan.

For example: if the overall plan contemplates the hiring of three doctorates, even if only one doctoral degree is funded through the core funding, the evaluation will be made on the overall action planned for the entity, that is, the hiring of the three human resources.

In relation to the form, information is requested for characterisation and foresight of the entity, already used in previous versions. In spite of this, there is nothing to prevent the entity from suggesting new indicators or metrics.

The application is made based on the years of funding, starting from May 2018. The three-year period ends in May 2021.

In the first year of funding (2018), a single transfer will be made 30 days after the signing of the financing agreement.

No. The total amount of the transfers related to the Core Funding shall not exceed 40% of the total contracted maximum amount to be funded in the 2018-2020 three-year period.

The remaining transfers (2019-2020) will be made 30 days after the submission and evaluation of the requested semi-annual and annual reports. Since payments are made in advance, there may be some adjustment after the final evaluation of the overall implementation of the plan in the amounts already funded, if applicable.

The monitoring of the implementation will be ensured by reviewing the implementation reports of the activity plan approved with the application.

Expenses associated with the execution of activities must be accounted for in accordance with current accounting regulations. In order to evidence the costs and income of non-economic activities and to prepare for audits, this accounting must be segregated by project.

As the funding is intended for non-economic activities - in accordance with the definition in the European Commission's Communication on the Framework for State aid for research, development and innovation (2014/C 198/01) - the Interface Centre must demonstrate that it is in a position to identify, in a segregated way, the economic and non-economic activities in its accounts, so the entity must maintain an analytical accounting system for this purpose.

In order to demonstrate this separation of activities, each entity shall introduce a specific point in the Annex to the Balance Sheet and Income Statement, presented in the Annual Report and Accounts, with the aggregation of costs, income and financing of each one of the major cost centres (Economic Activities and Non-Economic Activities).

The regime approved by Decree-Law 57/2016, of 29 August, applies only to the end-term recruitment of PhD students, using public funding, for the exercise of scientific, technological development, management and science and technology communication research at NSTS institutions, with a view to their strategic development and the reinforcement of investment in science and technology.

Under the Multi-annual Core Funding, this decree-law applies to both public and private entities.

Subject to compliance with the other provisions in force, the opening of the contest proceedings shall be publicised on the website http://www.eracareers.pt, administered by the STF.

No, the regime approved by Decree-Law 57/2016, of 29 August, applies to the end-term recruitment of doctorates for R&D and other related activities (see above). The recruitment of doctorates without a fixed term must be carried out in accordance with the Labour Code and other applicable legislation.

However, if the recruitment is done by way of opening the contest proceedings, it should be publicised in the portal http://www.eracareers.pt, administered by STF.

As stated in Notice 01/FITEC/2018, for the purposes of achieving Objective 3 of the Core Funding (reinforcing scientific employment by hiring young doctorates and other young technical staff), only the recruitment of doctorates up to the age of 40 (forty) in the year of recruitment, will be admitted.

Yes. As also noted in Notice 01/FITEC/2018, for the purpose of achieving Objective 3 of this Core Funding, the Interface Centre must demonstrate the contracting for an indefinite period of at least 50% of doctorates hired.

The first implementation report must be submitted 6 months after the signing of the funding contract (December 2018), and the following schedule shall apply:

The beginning of the implementation period of the funding of each Interface Centre is that mentioned in clause 4 of the Funding Concession Agreement ('Funding Implementation Period'). This date marks the beginning of Year 1 of funding.

Example 1: A TIC whose project started in June 2018, will only have to deliver the 1st implementation report in June 2019. This first report corresponds to the Annual Interim Report of Year 1.

Example 2: A TIC whose project began in November 2018, will have to deliver the first implementation report in June 2019 (corresponding to its Semi-annual Interim Report) and the Annual Interim Report in November 2019.

ANI provides a script with the support publicising rules, indicating the situations in which the funding obtained may be disclosed, the logos to be used, the minimum dimensions of the advertising material and the necessary templates.

No, the start date of the project, established in clause 4 of the Funding Concession Agreement, cannot be changed. The project's end date is 36 months after the start date.

Any change or occurrence that will or is likely to call into question the assumptions regarding the access conditions that allowed the application to be approved must be communicated.

For example:

It is not necessary to communicate or request prior authorisation for minor adjustments to the estimated investment amounts or the acquisition dates of services and equipment. These situations should be reported in the semi-annual and annual implementation reports. These documents should summarise the most relevant aspects that have occurred in the period to which they refer, as well as the results achieved and deviations from those established in the application.

Like FP7 (2007-2013), H2020 will run for 7 years (2014-2020) and its budget will be around EUR 79 billion, plus EUR 2.37 billion from Euratom.

The major new feature of H2020 lies in its structure, where the scientific and technological areas are no longer divided up into subjects (as in FP7), and the concept of Societal Challenges are introduced, which form part of Pillar III of H2020. This is based on two other pillars where science funding will help to develop Excellent Science (Pillar I) and forge European Industrial Leadership (Pillar II). More horizontal issues lie outside these pillars.

There are also some new features regarding the rules for participation and legal and financial aspects, which have been simplified. The vast majority of work programs, calls and budgets are biannual.

There is also a greater emphasis on industry and innovation, as well as on linking research to the market and society.

H2020 is structured based on three main pillars:

In addition to the three pillars, H2020 also has a budget for horizontal issues, such as the Euratom Programme (EUR 2.37 billion), the Joint Research Center (EUR 1.90 billion), and the European Institute of Innovation and Technology (EUR 2.71 billion).

This pillar supports the activities of the ERC (European Research Council) relating to cutting edge research, Future Emerging Technologies (FET), Marie Skłodowska-Curie Actions and European Research Infrastructure. Under this pillar, all research must be funded on the basis of excellence.

The budget for each of these activities will be:

The 'Industrial Leadership' Pillar arises as an incentive to increase the competitiveness of the European development industry and to support Leadership in Enabling and Industrial Technologies, LEIT (such as ICT, Nanotechnologies, Materials, Biotechnologies and Space Technologies). This Pillar also includes financial instruments to assist businesses (SMEs in particular) and to facilitate access to risk financing for innovative businesses and projects as a way of bringing innovation to the market.

The subjects addressed in this pillar will have the following budgets:

Innovation for SMEs: EUR 0.62 billion

The mission of Pillar III will be to increase the effectiveness of research and innovation to address key 'Societal Challenges' by supporting activities that should bring together resources and knowledge from different fields, technologies and disciplines.

These Societal Challenges, identified in the Europe 2020 Strategy, also represent major economic opportunities for innovative enterprises and, as a result, contribute to the Union’s competitiveness and employment.

Research on social sciences and humanities is an important element for meeting all of the challenges. Activities should cover the full range of research and innovation, with an emphasis on innovation-related activities such as pilot and demonstration projects, test-beds and support for public contracts, pre-normative research, setting standards and acceptance of innovations by the market. The activities must directly support the corresponding sector policy competences at a Union level. All challenges must also contribute to the general objective of sustainable development.

In addition to the subjects covered by the three Pillars, other projects may be funded by the following programs or instruments:

H2020 enables the creation of ambitious and lasting public-private partnerships in the form of Joint Technology Initiatives. The JTIs created in the former FP7 will be continued under H2020:

Further initiatives may be identified throughout the implementation of H2020.

Key Enabling Technologies (KETs) under the second pillar, 'Industrial Leadership', are technologies that require advanced knowledge and a high level of R&D in order to promote innovation in society and in the economy. KETs are interdisciplinary technologies that cover and include different sectors:

Horizon 2020 will include two different approaches for SMEs:

Knowledge and Innovation Communities (KICs) are the operational units of the European Institute of Technology (EIT) that work in interdisciplinary areas of strategic importance. Under Horizon 2020, 5 new KICs will be added to the existing ones ('Energy', 'ICT' and 'Climate Change'). The new KICs for the 2014-2020 period will be launched in three different phases:

The first H2020 calls will be published on 11 December 2013.

Work Programs, including calls, must be launched biannually but with annual deadlines for the submission of proposals. Call publication dates and their respective deadlines may vary depending on the programs.

The main types of projects under this Horizon will be Research and Innovation Actions (RIA) and Innovation Actions (IA).

Research and Innovation Actions are characterised by fundamental and applied research, technology development and integration. Innovation Actions are intended to produce plans or designs for new or improved products, processes or services. As these actions get close to being released onto the market, prototypes will be included to demonstrate the product and pilot its validation and replication.

The funding rate is 70% for market approach (AI) projects, whereas the rate is 100% for non-profit organisations.

Horizon 2020 also includes Coordination and Support Actions (CSA), Marie Skłodowska-Curie actions, ERC projects, the SME Instrument and Pre-Commercial Procurement (PCP) and Public Procurement of Innovative Solutions (PPI) actions.

Consortium agreements are mandatory for all multi-beneficiary (consortium) projects, unless otherwise specified in the call for proposals (Call).

According to the minimum conditions for participation, three independent legal entities from three different Member States or Associated States are required, which means that more than one entity per country may participate if the minimum is ensured. However, it is advisable to consult the specific Work Program for the call in question, as it may include additional conditions. For European Research Council Program actions, and for the SME Instrument, the participation of only one entity is, indeed, possible.

Eligible costs are those that are:

Under Horizon 2020, the existence of unit costs, flat rate costs and lump sum costs is also possible. Average personnel costs are also accepted if this is standard practice for the institution.

Ineligible costs are those which do not meet the conditions set out in the Financial Regulations, specifically provisions for possible future losses and charges, exchange rate losses, costs related to return on capital, costs reimbursed in relation to another Union or Programme action, debt and debt service charges, and excessive or bad expenses.

The funding rate for indirect costs for all research and innovation projects is 25%, for all types of entities.

Yes, non-recoverable VAT is an eligible cost for Horizon 2020 projects.

This is an IT system set up to prepare and submit proposals under FP7, which will also be used in H2020.

Access will be through the Participant Portal on the Call page.

A third country that is party to an international agreement with the European Communion, under the terms, or on the basis of which it makes a financial contribution to all or part of Horizon 2020.

To submit payment requests, the beneficiary must access the Simplified Access Platform (SAP).

On the Project Page, incentive payment requests are available under the 'Payment Request' icon:

The lead promoter has not yet granted access to the Project Page (only the lead promoter of the project will be able to give access to the remaining co-promoters).

To grant accesses, the lead promoter must access the Simplified Access Platform, and an 'Accesses' icon is available on the home page:

Accesses are granted here, in the 'Privileges | Accesses' section, using the 'New privilege | access' button:

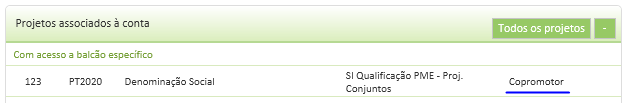

It must be completed as shown in the following image, i.e., the External Login corresponds to the NIF (Tax ID number) of the copromoter, the Access 'Project', Framework 'PT2020', with a Profile of 'Copromoter', and selecting the Project Number, in this example '123'.

This step must be repeated for all copromoters.

Example:

Project: 123

Lead Promoter: 500000000

Copromoter 1: 500000001

Copromoter 2: 500000002

Copromoter 3: 500000003

Internal users created by the copromoters may also be inserted in the External Login. For example, if NIF 500000001 has created the user 'Maria', the copromoter profile can be assigned directly to that user:

After assignment, it will be available in the 'Projects associated with the account' section on the PAS homepage of the copromoters:

The project’s specific page may be accessed from here.

Yes. This guide is available on the ANI website: IMPLEMENTATION OF PROJECTS

In past and current calls, no. However, there is nothing to prevent six-monthly periods being applied to projects in subsequent calls, following a decision by the Managing Authority.

Expenses incurred prior to the start of the project are not eligible, with the exception of down payments related to the project, up to 50% of the cost of each acquisition and expenses related to feasibility studies, provided that they were made less than one year before.

The first item of the Beneficiary Guidelines indicates all of the relevant elements in this regard. The file Payment Request – Checklist is a summary of the elements that must be sent to ANI upon submission of a payment request. However, the information contained in this annex is not intended to replace the information set out in the guidelines.

Payment requests can be certified by a Chartered Accountant (TOC) whenever the submitted expense amount is less than €200,000.00. For companies subject to statutory audits, any payment requests amounting to more than €200,000.00 must be certified by an official accounts auditor (ROC). The beneficiary may choose to always ensure that payment requests are certified by an ROC.

In the case of public entities, the competent manager in the Public Administration, appointed by the respective entity, may proceed to certifying payment requests.

Information regarding the stamp for the legalisation of expense documents can be found in the Beneficiary's Guidelines.

The placing of a stamp is mandatory on the following documents:

It is not necessary to stamp documents corresponding to expense payments. The stamp must always be placed on the original document and never on copies. For pay slips and the Social Security/GRF document, one single document must be considered the 'original'. All stamps from all sources of funding should be placed on this document, and the procedure for printing more than one stamped document is incorrect. The purpose of the stamp is to ascertain to which project an expense has been allocated, which may never exceed 100%.

According to Article 7(e) of the RECI, cash paid expenses made by beneficiaries to their suppliers are not eligible, except in situations where this proves to be the most frequent means of payment, depending on the nature of the expenses, and provided that the unit amount is less than EUR 250.

The PTA amount of the covered by a bank guarantee must be proven, at the latest, by the submission of the Final Refund Request (PTRF), or three years after the year of the down payment, or on 31 December 2023, whichever is earlier.

Assets acquired under a finance leasing scheme may be considered eligible for the purposes of calculating the incentive, provided that the contract provides for an option to purchase the asset and the promoter obligatorily exercises that option. The specific conditions for the eligibility of this type of expense are set out in Article 15(9) of the General ESIF Regulation (Decree-Law 159/2014).

No, these expenses do not fit the typology of expenses that are subject to financing.

These are situations where the purchaser does not have the possibility to exercise control over the seller or vice versa. Control arises from rights, contracts or any other means which, either separately or in combination and having regard to circumstances of fact and law, allow for the possibility of exercising a certain influence on a company, and specifically:

Control is acquired by persons or companies:

No, in these situations the amortisation rate approved in the application for the asset in question will be applied.

According to article 7(i) of the RECI, the acquisition of assets in a state of use is considered as an ineligible expense, except for the exception contained in article 2(r) of the RECI.

In this case, according to the calculation formula, 'the last 12 monthly base salaries plus holiday and Christmas bonuses' should be considered, and therefore reductions due to absences should not be taken into account.

In order to validate the annual remuneration of the technician indicated on the application, which made it possible to ascertain the value of the cost per hour, upon the first submission of project expenses corresponding to technical staff, entered under the simplified regime, evidence of the last 12 monthly base salaries must be sent to ANI (by means of pay slips, Social Security/General Retirement Fund statements, holiday sheets,...). After such verification, in subsequent payment requests, the beneficiary will not be required to send documents relating to these technicians, even if they have been selected for sampling purposes.

When monitoring projects, it is possible to change the simplified cost methodology selected during the application stage, to the actual costs methodology. In the case of replacements of technicians for whom the simplified cost methodology has been approved, the replacement technician must be associated with actual costs.

During monitoring it is not possible to change a technician identified on the application as being under the actual costs regime, to the simplified regime.

It should be noted that, in accordance with Article 76(9) of the RECI, the technical staff item is not eligible for any increase in approved funds and hours (no. of people/month).

A workload was approved on the application based on the number of person-months. During the project monitoring stage, the actual hours worked should be indicated and the number of person-months for control purposes should be calculated as follows:

No, meal allowance costs are not eligible. Therefore, they should not be added to the salaries of the technicians assigned to the project.

It is important to take into account all the procedures contained in the Research Grant file.

In accordance with Article 75(b) of the RECI, the technical profiles of the beneficiary’s staff, approved in the decision, must be maintained where applicable.

Therefore, any need to change the pre-established conditions must be requested from the ANI before the preparation of the notice, accompanied by the due justifications and evidence that it is impossible to contract the approved profile. For this purpose, the change request must be made in advance and requested using the Request for Contract Amendment text.

No. Only if this condition, as well as the term in which it will be in force, is provided for in the scholarship notice.

Yes, however, the alteration to the regime for hiring PhD trainees should be verified and safeguarded by the entities, as provided for in Decree-Law no. 57/2016. Please consult the FAQs available on the FCT website.

No, the hours (people_month) approved for trainees and newly hired staff cannot be transferred to staff on the workforce, as this implies changes to the terms of the project approval.

No, the logic of the profiles is precisely to differentiate between each of the technicians assigned to the project. However, more than one technician can be assigned to the same profile.

The types of expenses that can be included under these items are available in the Beneficiary Guidelines.

No. Assuming the simplified cost methodology based on the application of the fixed rate of 25% to direct eligible costs, when submitting expenses for reimbursement, there is no obligation to submit proof or a calculation method.

The purpose of publicising the support that is granted is to inform the final beneficiaries and the general public about the role played by the European Union, through structural funds, and by the Portuguese state, within the scope of Portugal 2020, in co-financed projects and operations and their respective impacts and results. It is mandatory to publicise the support, and information regarding the publication rules can be consulted in the IMPLEMENTATION OF PROJECTS.

The structure of the interim technical-scientific report is available in the Technical-Scientific Report file, which can be found on the IMPLEMENTATION OF PROJECTS page.

Technical-scientific reports must be submitted whenever a payment request is submitted, or periodically, at a frequency not exceeding 12 months.

Requests for contractual amendments must be submitted using the template stipulated for this purpose, which can be found on the Contractual Amendment Request form.

Regardless of the nature of amendment requests, they must all be presented in a single document and submitted to the project manager for appraisal.

Yes. For this purpose, the request must be sent to ANI, on the Contractual Amendment Request form, by submitting the justification for his/her replacement. The CV of the proposed new technician must be sent. It should be noted that the project manager must always be a technician forming part of the approved technical team.

Yes. Requests for changes to the Bank Account Number/IBAN may be made through the Project Page (Simplified Access Platform). To validate the request, the document from the bank proving the new Bank Account Number/IBAN must be uploaded to:

The technical staff item may not be increased in any way, neither in terms of the funding or the approved hours. It is only possible to replace the initially approved technicians, using the Contractual Amendment Request form, by submitting the justification for their replacement and sending the CVs of the proposed new technicians.

The SIFIDE application must be submitted by the end of May of the year following the financial year.

The completed form is sent electronically, here.

After checking the conformity of the application (duly completed form and verification of all of the requested annexes), the respective proof of Tax Credit request will be sent to the company, for the purposes of Article 40(1) of Law no. 162/2014 of 31 October.

Companies with a tax period that do not coincide with the calendar year must submit their SIFIDE II application by the last day of the fifth month following the date of the end of the tax period to which the R&D expenditure relates (in line with the spirit of the Law, which stipulates the last day of the month of May for companies with a tax period equal to the calendar year).

The criteria used to identify and distinguish R&D activities include the presence of an appreciable element of novelty and/or the resolution of a scientific-technological uncertainty. See here for more information.

Form - description of projects

Form - description of projects

The descriptive fields of the application form should answer the following points:

|

1. Objectives |

-Industrial and/or business context of the project; -Scientific/technological motivation for the proposed development; -Technical-scientific objectives. |

|

2. Description of the R&D Activities |

-Presentation of the state of the art in the technical-scientific domain related to the object to be investigated & developed; -Presentation of the scientific/technological uncertainty that the project sought to solve; -Description of the systematic work and methodology developed by the work team; -Justify the extent to which the solutions found could not have been developed by someone with knowledge/skills in the technical fields of the area in question, and knowledge of techniques commonly used in the sector. |

|

3. Results |

-Presentation of the results obtained during the reference period; -Critical analysis of deviations from objectives and possible future needs; -Project conclusions. |

Form - description of projects

The descriptive fields of the application form must answer the following points:

|

1. Objectives |

-Industrial and/or corporate context of the project; -Scientific/technological motivation for the proposed development; -Technical-scientific objectives. |

|

2. Description of the R&D Activities |

-Presentation of the state of the art in the technical-scientific domain related to the object to be investigated & developed; -Presentation of the scientific/technological uncertainty that the project sought to solve; -Description of the systematic work and methodology developed by the work team; -Justify the extent to which the solutions found could not have been developed by someone with knowledge/skills in the technical fields of the area in question, and knowledge of techniques commonly used in the sector. |

|

3. Results |

-Presentation of the results obtained during the reference period; -Critical analysis of deviations from objectives and possible future needs; -Project conclusions. |

|

1. Objectives |

|

- Industrial and/or corporate context of the project; |

|

2. Description of the R&D Activities |

|

- Presentation of the state of the art in the technical-scientific domain related to the object to be investigated & developed; - Presentation of the scientific/technological uncertainty that the project sought to solve; |

|

3.Results |

|

- Presentation of the results obtained during the reference period; |

It is not necessary to attach any expense documents. The correct completion of the expenditure tables on the application form is sufficient.

The rates in force for this financial year are:

An increase of 15% is applied to the base rate for corporate taxpayers (IRC) who are SMEs according to the definition in Article 2 of Decree-Law no. 372/2007, of 6 November, that have not been in existence for two financial years and who have not benefited from the incremental rate.

Yes, in the respective percentage of participation in the project(s).

Resources with educational qualifications lower than level 4 of the National Qualifications Framework may be entered under the item 'Operating Expenses'.

In this case, the corresponding expense considered will be 120% of the amount, and the company should present the actual value of this resource on the form.

Yes, except for all expenses incurred in connection with projects carried out exclusively on behalf of third parties, specifically through contracts and the provision of R&D services.

Under the scope of SIFIDE, the figures contained in the applications are compared with information in the databases of financial support systems. Eligible expenses are those that were considered under those Programs, provided that they are also eligible under the terms of SIFIDE.

Yes, regardless of the nature of the grant (Portuguese State or European Commission), it will always be deducted from the eligible expense. However, the application form must include the total expense per item.

In this case, the company should make the respective conversion to a non-repayable grant, using the new simulator available here.

'Ecodesign' shall have the definition used in DIRECTIVE 2009/125/EC of the European Parliament and of the Council of 21 October 2009.

The company must complete a form (available soon) for each of the Ecological Product Design projects, which must be attached to the SIFIDE application.

The following entities are currently recognised.

In the case of expenses provided for in line e), suitability for practising R&D activities is also recognised for Universities, State and Associated Laboratories, R&D Units and other technological infrastructure.

National entities interested in obtaining recognition must submit the application form, available under "ENTER", after company registration.

The form consists of two parts:

Any foreign entities interested in obtaining recognition must submit an application to Agência Nacional de Inovação, S.A., identifying the areas of activity and attaching the following documentation:

Documentation must be sent to sifide@ani.pt.

Recognition is valid until the eighth financial year following that in which it was requested, pursuant to Article 37(2) of Decree-Law no. 162/2014 of 31 October, as currently in force.

Entities whose suitability has been recognised over 8 years before shall be reassessed and may be contacted by the National Innovation Agency to update the information. Should they wish to do so, entities may apply for reassessment by submitting the application for recognition of suitability, as specified in the previous question.

Article 40: 'The entities benefiting from SIFIDE undertake to report annually, within two months after the end of each financial year, to Agência Nacional de Inovação (ANI), S.A., by means of a table of indicators to be made available by this entity, the results of the activities supported by the granted tax incentive, for five years following its approval'

It is the ANI's interpretation that companies should respond to these indicators 2 months after the closure of the assessment of the application, once the results of the activities supported by the granted tax incentive have been requested.

The indicator table must be sent to sifide@ani.pt.

It is also hereby informed that companies that do not submit applications in consecutive years are subject to this obligation over the 5 years following the approval of the incentive.

All companies that have obtained a tax credit for R&D activities approved by SIFIDE must reply.

Regardless of whether or not they submit an application to SIFIDE, it is mandatory to respond to the survey within 5 years following the granting of the credit.

The aim is to obtain information on the results of projects approved, ongoing or completed in the year in question. The application year should be taken as the reference year, and not the year of completion of the survey..

If the company only presents ongoing projects during the reference year, it must simply complete the 'Annual Activity' tab. If it submits projects that ended in the reference year, it must also respond to the respective project tab.

No. You must only respond to the requested aspect, and not add any new lines or columns.

This tab intended for the results arising from all projects approved under the scope of SIFIDE, regardless of whether they are in progress or if they were completed during the reference year.

The 'Job creation' table is for the number of jobs created in all areas of the company, provided that they originate in the R&D activities that benefited from SIFIDE funding.

The 'Industrial property' must only indicate the number of registrations/licenses made/issued following projects approved by SIFIDE.

When ascertaining the 'Sales Volume of SIFIDE-supported projects', only products or services originating in SIFIDE-supported projects should be considered.

The 'Exports' table is intended only for exports that originated in projects approved under the scope of the SIFIDE.

The 'Collaborative projects' table must consider contracts entered into with entities and/or companies during the course (or after the conclusion) of SIFIDE-supported projects. For example, during the implementation of the project, the company may contract another with a recognised identity for practising R&D activities.

It is not necessary. Item 3 should only be filled in if any project has actually been completed in the year in question.

You should only list projects completed in the reference year, the information of which must be updated over the 5 following years, by recording the evolution and adding any other projects that are completed in the meantime.

You can consult the list of Funds certified by ANI here.

It's a Fund whose Management Regulations are in accordance with the SIFIDE legislation in force at the time.

The investment made should be included in paragraph f) Equity in R&D institutions and contributions to funds for financing R&D.

In addition to the usual documentation, the necessary attachments are:

No, according to Article 37(9) of the ITC, they do not need to obtain or apply for recognition as a Technology Sector Company.

Yes, provided they are incubated in a certified incubator.

You should access ANI's website, fill in the online form and submit the requested documents.

Yes, it should be incubated in a certified incubator or present, in the previous year, an R&D investment of at least 7.5% of its turnover, even if it has already completed 6 years of activity.

No. In order to be eligible for investment in R&D by the funds they must obtain recognition of suitability for Research & Development under Article 37(A) of the Investment Tax Code.

They are separate applications and both have to meet the respective eligibility requirements.

According to Article 2 of Ordinance no. 295/2021, of 23 July, 'employers with their head office or effective management in Portugal, as well as non-resident employers with permanent establishment in Portugal, who carry out, as their main activity, a commercial, industrial or agricultural activity, and who cumulatively meet the following conditions, are considered subject to this scheme:

The expression '(...) carry out, as their main activity, a commercial, industrial or agricultural activity (...) (free translation) is an expression enshrined in tax legislation, namely in Article 3 of the Corporate Income Tax Code, which states, in paragraph 4, that 'For the purposes of the provisions of this Code, all activities consisting in the performance of economic operations of corporate nature, including the provision of services., are considered to be of a commercial, industrial or agricultural nature' (free translation), therefore one should consider that the scheme is also applicable to entities that exercise, mainly, any corporate activity.

As set out in Article 7(3) of the Ordinance, the employment level must be maintained 'in the months between October 2020 and the month preceding that of the application', pursuant to Article 3(3).

According to Article 3(3) of the Ordinance, the average number will be calculated by the Social Security services, based on the number of workers at the service of the entity at the end of October 2020 and the number of workers at the service of the entity in the month prior to the month in which the application is submitted.

According to Article 2(2) of Ordinance 295/2021, 'The maintenance of the employment level is considered to have been observed whenever, by the end of the month prior to the month of application, use or training of the public support or tax incentive, when applicable, the entity has an average number of workers at its service that is equal to or greater than that observed in October 2020' (free translation)”.

In parallel, under the terms of Article 3(5)(a), the legislator established 'the prohibition to terminate employment contracts under the collective dismissal, termination of employment or dismissal due to unsuitability, provided for in articles 359, 367 and 373 of the Labour Code', approved in annex to Law no. 7/2009, of 12 February, in its current wording, respectively, as well as to initiate the respective procedures, until 31 December 2021, without prejudice to the provisions of Article 2(d) of annex V of Law no. 27-A/2020, of 24 July”.

) “These provisions of the Ordinance are the implementation of the provisions of Article 403(4) of Law no. 75-B/2020, of 31 December (State Budget Law for 2021), which states in point a) that the granting of the public support and tax incentives in question implies, for the entities covered by this scheme (that is, companies with positive net results in the 2020 period that do not qualify as micro-, small- or medium-sized companies),The prohibition of terminating employment contracts under the collective dismissal, termination of employment or dismissal due to unsuitability modalities, provided for, respectively, in articles 359, 367 and 373 of the Labour Code, as well as the initiation of the respective procedures until the end of 2021”.

Consequently, companies that have terminated 'employment contracts under the collective dismissal, termination of employment or dismissal due to unsuitability modalities' or have initiated until the end procedures for termination of employment contracts under one of these modalities will not be able to benefit from the tax benefit in financial year 2021.

In the case of a reduction in the employment level identified by Social Security, the company shall be given the possibility to demonstrate that this reduction results from the verification of any of the situations foreseen in Article 4(1)(b) of Ordinance 295/2021, of 23 July, and therefore shall not be counted for the purposes of verifying the maintenance of the employment level.

In addition, in accordance with the provisions of paragraph 2 of the same article, the entities subject to the scheme may also demonstrate that, in the overall number of entities with which they have a reciprocal participation, control or group corporate relationship, even if not subject to the scheme, the maintenance of the employment level was observed, under the terms and conditions foreseen in the present scheme, only counting for this purpose the entities that have their head office or effective management in Portugal or the permanent establishments of those entities located in Portugal.

Yes. Failure to comply with the duty to maintain the employment level implies the suspension of the right to use the said benefits during the tax period beginning on or after January 1st, 2021.

Nonetheless, the benefits may be used in subsequent periods, provided that the necessary legal requirements are met, as well as the presentation of the respective applications.

No. A company is not required to demonstrate compliance with the criterion at group level and can benefit from the tax incentives even if there has been a reduction in employment at group level.